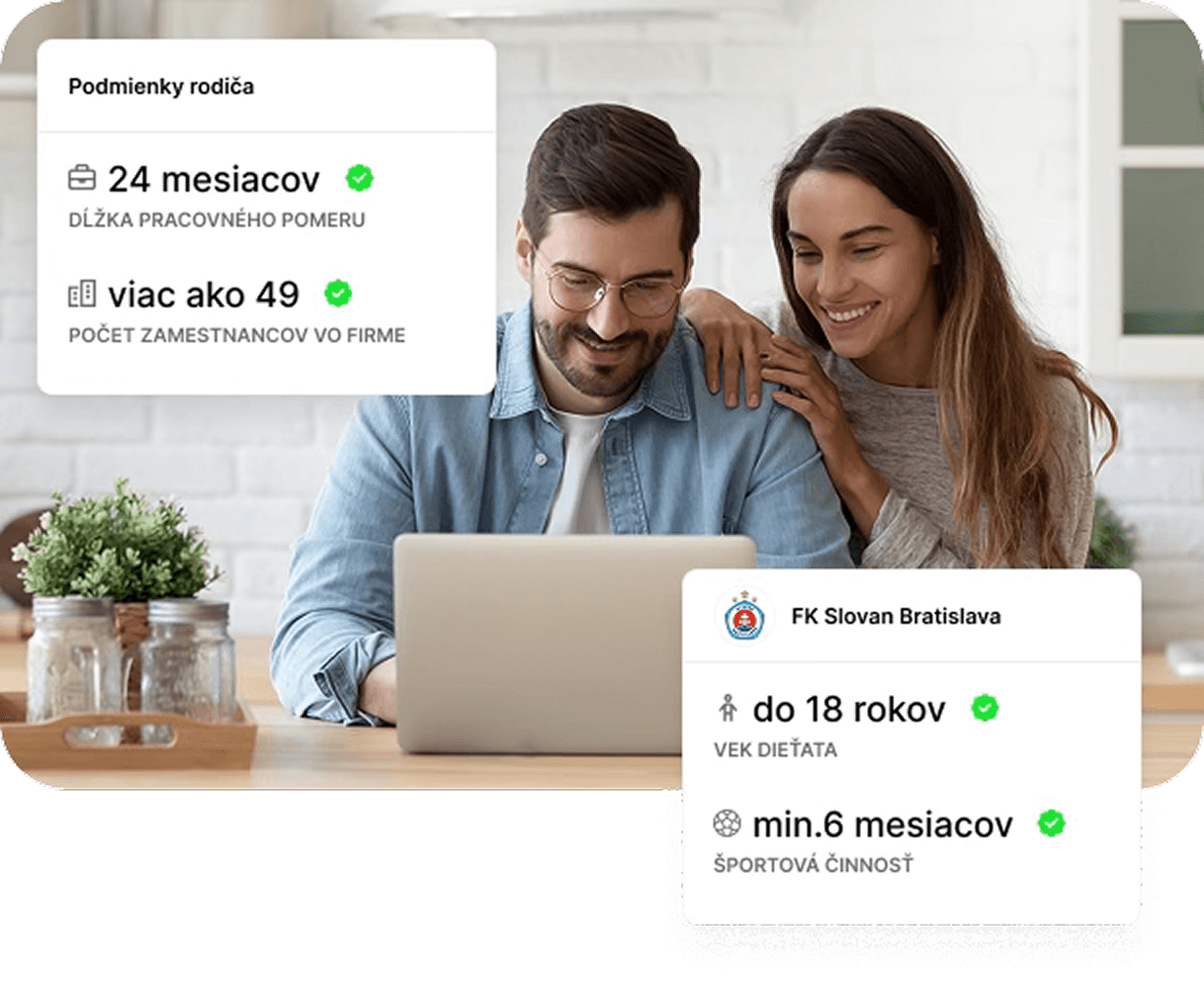

Stress-free automation

Thanks to Paysy, both parents and sports clubs save time – instead of lengthy manual processing of contributions for a child’s sports activity, the entire process is automated, transparent and stress-free for everyone involved.

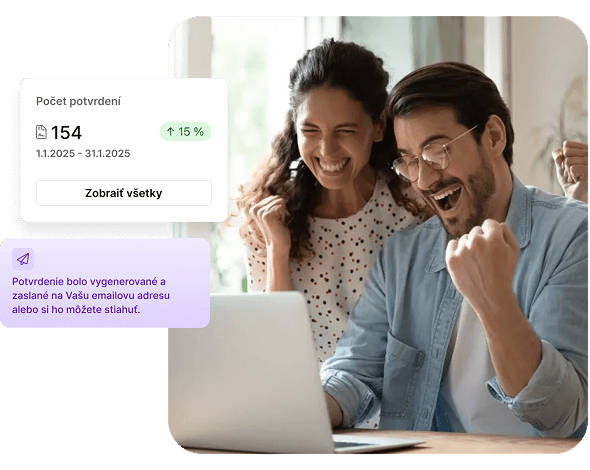

93%

Time savings for the sports club

Thanks to automation, the sports club manager practically does not have to deal with this agenda at all.

99%

Time savings for the parent

The parent does not need to call anyone and ask for a confirmation, because they can generate it themselves after logging in, in just a few clicks.